We trade stocks, bonds, commodities, currencies, and cryptocurrencies using advanced, continuously evolving algorithms that monitor global markets and execute trades 24/7. Our strategies are designed to compound our internal proprietary capital, generating consistent, risk-adjusted returns that we subsequently deploy into stable, income-producing net leased real estate transactions. By combining quantitative trading with long-term real estate acquisitions, we convert short-term market efficiencies into durable cash-flowing assets—creating a diversified, self-funded investment engine that supports new ground-up developments and single-tenant net leased opportunities across the Carolinas and beyond.

INVESTMENT FOCUS/ACQUISITION APPROACH

EXPERIENCE

Over 30 years of trading

experience. 13 years of algorithmic trading research

Instruments

Stocks, bonds, commodities,

currencies and crypto

Strategies

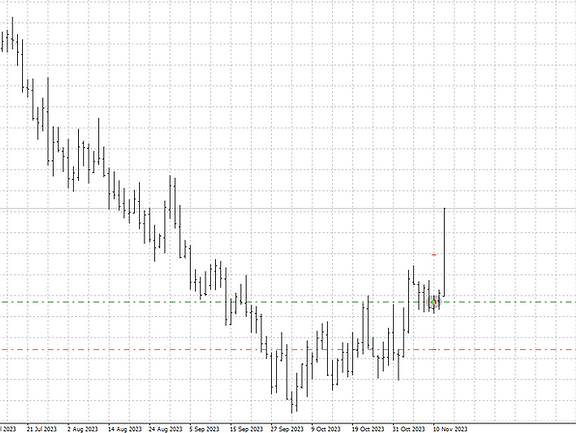

Global Macro; Long/Short

Event Driven; Arbitrage

Reward to Risk Profile

-

Minimum 3:1 reward to risk profile on every trade.

-

Algorithm's run 24/7, watching and protecting capital constantly

-

Every trade utilizes a stop loss, minimizing downside risk.

-

Maximum of 2% of total equity on any single trade.

-

Risk control is paramount to everything.

-

Every strategy extensively back tested and optimized through a genetic algorithm.

Long & Short Term Trend Strategies

Long & Short Term Mean Rev. Strategies

Volatility Strategies